Insurers use the 80% rule as a guideline to determine the minimal amount of coverage a homeowner must maintain on their property to avoid underinsurance penalties. In accordance with this regulation, landowners are required to insure their property for a minimum of 80% of its total replacement cost value. Homeowners must comprehend the 80% rule to guarantee that they have sufficient insurance coverage and are adequately equipped to handle potential losses. Several considerations must be taken into account when attempting to comprehend the 80% rule.

Replacement Cost vs. Actual Cash Value:

Before discussing the 80% rule, it is critical to comprehend the distinction between actual currency value coverage and replacement cost coverage. Without depreciation consideration, replacement cost coverage reimburses the cost of fixing or replacing damaged property with new items of comparable quality and type. Actual cash value coverage, on the other hand, factors in depreciation when reimbursing for damaged property.

Application of the 80% Rule:

The 80% rule applies to the dwelling coverage limit in a homeowners insurance policy. It states that homeowners should insure their dwelling for at least 80% of its total replacement cost value. This means that the dwelling coverage limit should be equal to or greater than 80% of the cost of rebuilding the home from the ground up with similar materials and construction methods.

Purpose of the Rule:

The primary purpose of the 80% rule is to ensure that homeowners have adequate coverage to fully rebuild their home in the event of a total loss. By requiring homeowners to carry a minimum of 80% of the replacement cost value in dwelling coverage, the rule aims to prevent situations where homeowners are underinsured and unable to afford the cost of rebuilding their homes to their pre-loss condition.

Penalties for Underinsurance:

If a homeowner fails to meet the 80% threshold and is underinsured at the time of a covered loss, they may face penalties in the form of reduced claim payments. In the event of a partial loss, the insurance company will only pay a proportionate amount of the claim based on the percentage of coverage carried compared to the 80% requirement.

Example:

If a home's replacement cost is $500,000, the homeowner should carry at least $400,000 (80% of $500,000) in dwelling coverage. If the homeowner only carries $300,000 in coverage and experiences a $200,000 loss, the insurance company will only pay 75% of the claim ($300,000 / $400,000), resulting in a penalty for underinsurance.

Exceptions and Alternatives:

While the 80% rule is a common guideline used by insurers, some policies may offer alternatives or endorsements that provide additional protection against underinsurance. These options may include guaranteed replacement cost coverage, which ensures that the insurer will cover the full cost of rebuilding the home, regardless of the coverage limit.

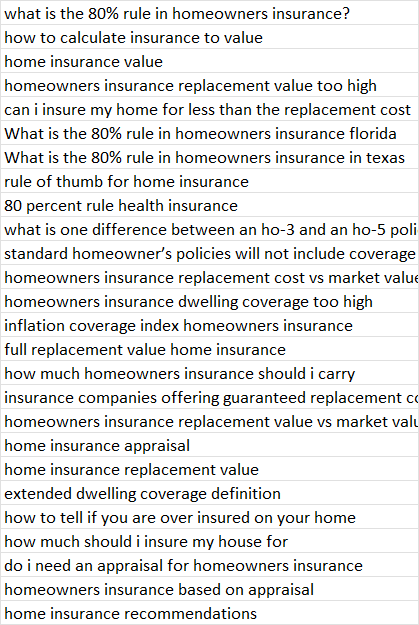

| what is the 80% rule in homeowners insurance? |

| how to calculate insurance to value |

| home insurance value |

| homeowners insurance replacement value too high |

| can i insure my home for less than the replacement cost |

| What is the 80% rule in homeowners insurance florida |

| What is the 80% rule in homeowners insurance in texas |

| rule of thumb for home insurance |

| 80 percent rule health insurance |

| what is one difference between an ho-3 and an ho-5 policy |

| standard homeowner’s policies will not include coverage for damage done by: |

| homeowners insurance replacement cost vs market value |

| homeowners insurance dwelling coverage too high |

| inflation coverage index homeowners insurance |

| full replacement value home insurance |

| how much homeowners insurance should i carry |

| insurance companies offering guaranteed replacement cost |

| homeowners insurance replacement value vs market value |

| home insurance appraisal |

| home insurance replacement value |

| extended dwelling coverage definition |

| how to tell if you are over insured on your home |

| how much should i insure my house for |

| do i need an appraisal for homeowners insurance |

| homeowners insurance based on appraisal |

| home insurance recommendations |