Home insurance coverage for evacuation expenses during flooding depends on various factors, including the type of policy you have, the cause of the flooding, and the specific provisions outlined in your insurance contract. Flood damage is frequently not covered by regular home insurance plans, even though they usually cover damage to your property brought on by unplanned or unexpected incidents like burst pipes or broken appliances. However, some policies offer optional coverage for flooding through separate flood insurance policies. Here is a detailed breakdown to better comprehend evacuation expenses.

Flood Insurance:

If you have a separate flood insurance policy, it may cover certain evacuation expenses. This coverage can include expenses for temporary housing, transportation costs to evacuate, and additional living expenses incurred during evacuation. However, coverage can vary depending on your policy's terms and limits.

Mandatory Evacuation Orders:

In cases where local authorities issue mandatory evacuation orders due to imminent flooding, your home insurance policy may cover some evacuation expenses. These expenses typically include costs associated with temporary lodging, transportation, and meals. However, coverage may be subject to limits and deductibles.

Voluntary Evacuation:

If you voluntarily evacuate your home due to the risk of flooding, your home insurance may not cover evacuation expenses unless your policy explicitly states otherwise. However, some insurers may offer limited coverage for voluntary evacuation expenses as a goodwill gesture or through optional endorsements.

Additional Living Expenses (ALE):

ALE coverage, included in most standard home insurance policies, typically covers expenses incurred if you're temporarily displaced from your home due to covered perils, including flooding. This coverage can include hotel bills, meals, and other necessary expenses. However, it's crucial to review your policy's ALE provisions to understand the extent of coverage.

Policy Exclusions and Limits:

Like any insurance coverage, there may be exclusions and limits on coverage for evacuation expenses during flooding. For example, coverage may be limited to a certain dollar amount or time period. Please see your insurance agent or study your policy documentation thoroughly to familiarize yourself with these restrictions.

In summary, while home insurance may provide coverage for evacuation expenses during flooding under certain circumstances, it's essential to carefully review your policy and understand its provisions. If you reside in a flood-prone area, consider obtaining supplemental flood insurance to give more complete coverage for evacuation costs and flood-related damages. Always consult with your insurance provider to clarify any uncertainties and ensure you have adequate coverage for potential evacuation situations during flooding.

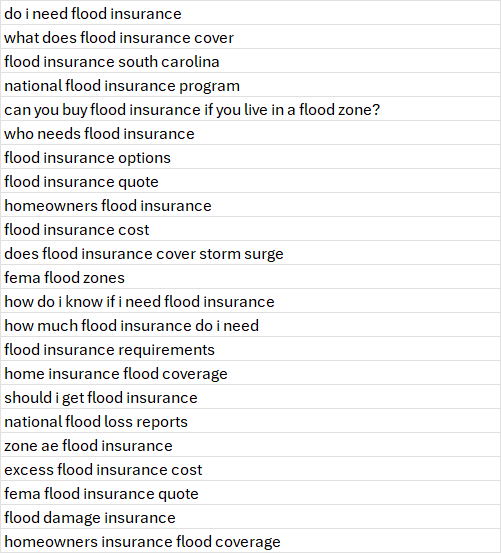

| do i need flood insurance |

| what does flood insurance cover |

| flood insurance south carolina |

| national flood insurance program |

| can you buy flood insurance if you live in a flood zone? |

| who needs flood insurance |

| flood insurance options |

| flood insurance quote |

| homeowners flood insurance |

| flood insurance cost |

| does flood insurance cover storm surge |

| fema flood zones |

| how do i know if i need flood insurance |

| how much flood insurance do i need |

| flood insurance requirements |

| home insurance flood coverage |

| should i get flood insurance |

| national flood loss reports |

| zone ae flood insurance |

| excess flood insurance cost |

| fema flood insurance quote |

| flood damage insurance |

| homeowners insurance flood coverage |